And it pays this at the corporate tax rate, not your personal income tax rates. Corporation Income Tax Return.Īn LLC taxed like a C corporation pays income tax only on its net profit for the tax year. Instead, C corporations must pay income taxes on their net income and file their tax returns with the IRS using Form 1120, U.S. Profits and losses do not pass through to the owners’ individual tax returns as they do with the sole proprietorship form of taxation. Unlike a sole proprietorship, a C corporation is a separate entity from its owners for income tax purposes. You can elect to have your LLC taxed either way.Ĭ corporation taxation is the default mode of taxation for LLCs that elect to go this route. There are significant differences between these types of corporate taxation.

Unlike a sole proprietorship, a partnership is separate from the partners when computing income and deductions. If the business incurs a loss, it is likewise shared among the owners who may deduct it from other income on their returns, subject to certain limitations.

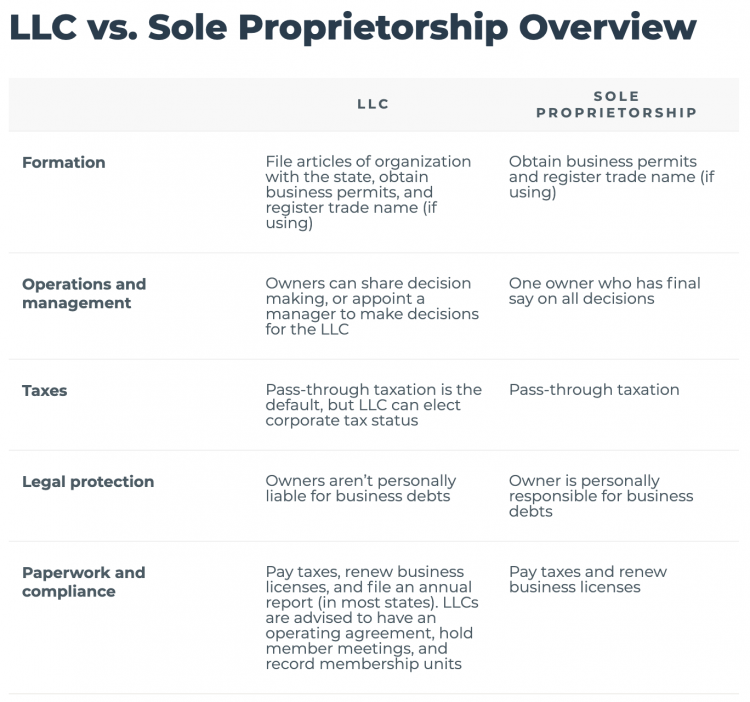

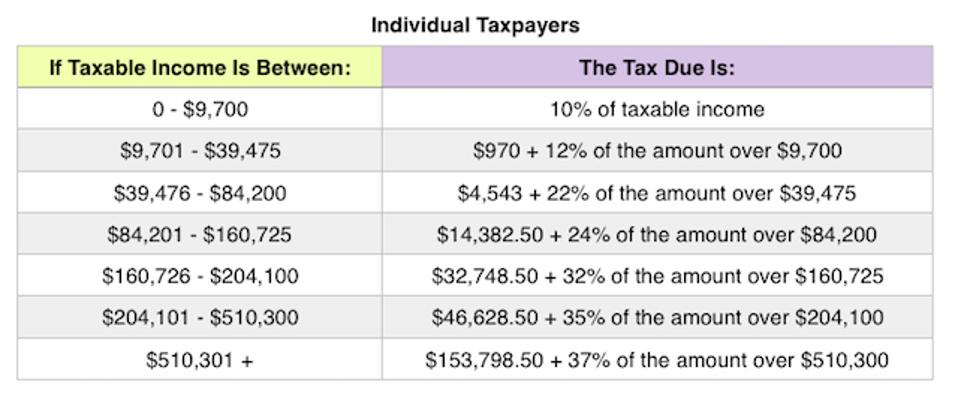

If the business has a profit, the owners pay income tax on their ownership share on their individual returns at their income tax rates. Instead, the profits, losses, deductions, and tax credits of the LLC business get passed through the company to the owner’s individual tax returns. This means that the LLC ordinarily pays no taxes itself. With partnership tax treatment, the LLC is a “pass-through entity” for tax purposes. Partnership taxation is the default tax treatment for LLCs with more than one member. You also file IRS Form SE to show the Social Security and Medicare tax you must pay on your net self-employment income. On this form, you list all your business income and deductible expenses. To show whether you have a profit or loss from your LLC, you must file IRS Schedule C, Profit or Loss From Business, with your personal tax return. If you earn a profit, the money gets added to any other income you have-for example, interest income or your spouse’s income if you’re married and file a joint tax return-and that total gets taxed at your personal income tax rates.Īlthough you pay taxes on your total income regardless of its source, the IRS still wants to know about the profitability of your LLC business. Instead, you must report the income you earn or losses you incur from your LLC on your personal tax return (IRS Form 1040). Your LLC doesn’t pay taxes or file federal tax returns. When taxed as a sole proprietor, you and your business are the same for tax purposes. Sole proprietor taxation is the default federal tax treatment for single-member LLCs. Which default tax treatment applies depends on whether the LLC has a single member (owner) or multiple members. When you first form an LLC, it is automatically taxed as a sole proprietorship or partnership. But you have the option of choosing out of the default mode. There is yet another advantage afforded by LLCs: They provide great flexibility when it comes to taxation.Īll LLCs come with a default form of taxation.

0 kommentar(er)

0 kommentar(er)